NY RP-5217 ppt free printable template

Show details

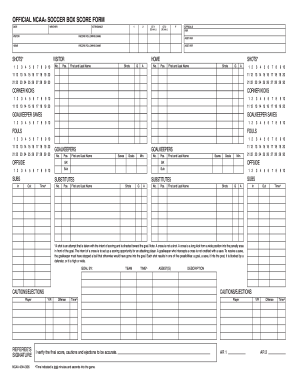

RP5217 Real Property p y Transfer Reporting1NYSORPTS Contact Information Data Management Unit 5184739791Office of Counsel 51847488212Real Property Law Article 9, Section 333 Establishes the requirement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rp 5217 form

Edit your fillable form pdffiller com form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny rp 5217 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

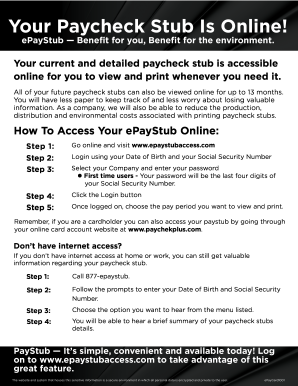

How to edit rp 5217 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rp 5217 fillable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rp 5217 fillable form

How to fill out NY RP-5217 ppt

01

Obtain the NY RP-5217 form from the New York State Department of Taxation and Finance website or a local office.

02

Fill in the property owner's name and address at the top of the form.

03

Indicate the buyer's name and address in the designated section.

04

Provide the property description, including the county, city, town, or village.

05

Categorize the property type (residential, commercial, etc.) as specified on the form.

06

State the sale price of the property clearly.

07

If applicable, list any exemptions or adjustments on the form.

08

Review the completed form for accuracy and ensure all sections are filled out.

09

Sign and date the form where indicated.

10

Submit the form to the appropriate local tax office when completing the property transfer.

Who needs NY RP-5217 ppt?

01

Property sellers and buyers in New York State who are involved in a real estate transaction.

02

Real estate professionals, including agents and brokers, assisting clients with property transfers.

03

Attorneys handling real estate transactions for their clients.

Fill

rp5217

: Try Risk Free

People Also Ask about form rp 5217

How much does it cost to file a NYS RP-5217?

(The filing fee is NOT required from the County or State, but the filing of the RP-5217 is required.) 3. Fee is $125, if Item 7A, 7B, 7E or both 7G & 8 have been checked on the RP-5217 OR Item 18 is equal to 100–199, 200-299 or 411-C. Fee is $250 for all other RP-5217‟s.

What is NYS Form RP-5217?

RP-5217 Real property transfer report; sales reporting.

What is a New York form of deed?

A New York deed is a form used to convey property ownership from a seller (grantor) to a buyer (grantee). The deed, whichever selected, is usually written at the time of closing which is usually the same date when the money transfers from the Grantee to the Grantor.

How do I transfer property to family members in NY?

When you want to convey, or transfer, real property to someone else, either by sale, gift, or by court order, you must do so by using a written document that satisfies the requirements of the law in your state. This document is either a bargain and sale deed, a warranty deed, or a quitclaim deed.

Who pays real estate transfer tax in NY?

In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.

How much does it cost to file Rp-5217 NYC?

(The filing fee is NOT required from the County or State, but the filing of the RP-5217 is required.) 3. Fee is $125, if Item 7A, 7B, 7E or both 7G & 8 have been checked on the RP-5217 OR Item 18 is equal to 100–199, 200-299 or 411-C. Fee is $250 for all other RP-5217‟s.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdf?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rp 5217 instructions and other forms. Find the template you need and change it using powerful tools.

How do I make changes in nys rp 5217?

The editing procedure is simple with pdfFiller. Open your rp 5217nyc in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit it rp 5217 is required to and the financial aspects of the transfer on an Android device?

With the pdfFiller Android app, you can edit, sign, and share rp 5217 printable form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NY RP-5217 ppt?

The NY RP-5217 ppt is a Property Transfer Report form required in New York State to document the transfer of real property.

Who is required to file NY RP-5217 ppt?

The seller of the real property is required to file the NY RP-5217 ppt in conjunction with the transfer of the property.

How to fill out NY RP-5217 ppt?

To fill out the NY RP-5217 ppt, you need to provide details about the property, including the property identification, the names of the parties involved, and the nature of the transaction.

What is the purpose of NY RP-5217 ppt?

The purpose of the NY RP-5217 ppt is to ensure proper documentation of property transactions for tax assessment and reporting purposes.

What information must be reported on NY RP-5217 ppt?

The NY RP-5217 ppt must report information such as the property address, the type of transaction, the sale price, and the names and addresses of the buyer and seller.

Fill out your NY RP-5217 ppt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rp 5217 Pdf Form is not the form you're looking for?Search for another form here.

Keywords relevant to form rp 5217 pdf

Related to nys rp 5217 fillable form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.