Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

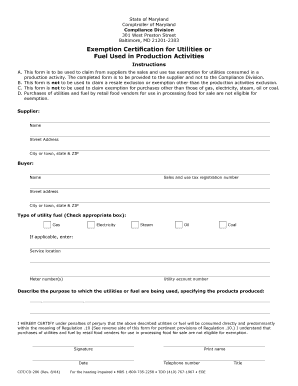

1. Fill out your name, address, and telephone number at the top of the form.

2. On the first page of the form, check the box indicating the type of form you are filing (for example, “Application for Registered Professional Nurse”).

3. Fill out the appropriate sections on the form. For example, fill out Section A if you are applying for an initial certificate or license, or Section B if you are applying for renewal.

4. Submit the appropriate fee, if required.

5. Attach the required documents, such as transcripts, diplomas, certificates, and letters of reference.

6. Sign and date the form.

7. Mail the completed form and attachments to the address indicated on the form.

What is the purpose of rp 5217?

RP 5217 is a recommended practice issued by the American Petroleum Institute (API) which provides guidance on the installation, maintenance, and operation of electrical apparatus used in hazardous locations. It is designed to help ensure that electrical apparatus is installed and operated in a safe manner, reducing the risk of an explosion or other hazardous event.

RP-5217 is a New York State Department of Taxation and Finance form used for recording and reporting real property transfers. It is required to be filled out and submitted to the local county clerk's office whenever there is a transfer of real property, such as when buying or selling a house or land. The form includes information about the property, the buyer and seller, and the financial aspects of the transfer. It is used for establishing the property's market value for assessment and taxation purposes.

Who is required to file rp 5217?

In New York State, individuals or entities involved in a transfer of real property must file RP-5217 form with the county clerk's office. This may include buyers, sellers, or their authorized representatives. Additionally, the New York State Department of Taxation and Finance requires the completion of Form TP-584, which must be filed with the RP-5217 form.

What information must be reported on rp 5217?

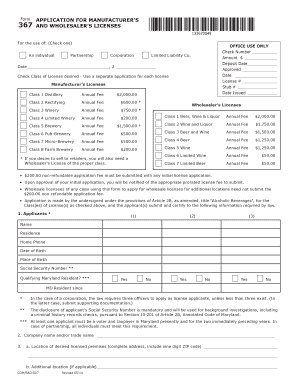

RP-5217 is a form used in New York State for reporting real property transfer tax and recording fees. The following information must be reported on the RP-5217 form:

1. Tax Map Designation: The tax map identification number of the property being transferred.

2. Section and Block: The section and block numbers of the property.

3. Property Address: The street address of the property being transferred.

4. Property Classification: The classification of the property, such as residential, commercial, agricultural, etc.

5. Sale Information: Details about the sale, including the date of transfer, the consideration (sale price), and the type of deed being used (e.g., warranty deed, quitclaim deed).

6. Buyer and Seller Information: The names, addresses, and social security numbers or federal ID numbers of the buyer(s) and seller(s) involved in the transaction.

7. Recording Information: The name and address of the person or party responsible for recording the deed and paying the recording fees.

8. Affidavit of Exemption: If applicable, any exemptions from real property transfer tax must be declared and substantiated with the necessary documentation.

9. Signature and Notarization: The form must be signed by both the buyer and seller, and notarized.

It is important to note that specific requirements may vary by county within New York State, so it's advisable to consult the local county clerk's office or website for any additional information or documentation that may be required.

What is the penalty for the late filing of rp 5217?

In New York State, the penalty for the late filing of RP 5217 (also known as the Real Property Transfer Report) can vary depending on the circumstances. Generally, if the report is filed late but within 30 days of the transfer date, there is a penalty of $100. If it is filed more than 30 days late, the penalty increases to $500. It is important to note that additional penalties or consequences may apply depending on the specific situation and local regulations, so it is advisable to consult with a legal professional or relevant authorities for accurate and up-to-date information.

How can I get ny rp 5217?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rp 5217 pdf form and other forms. Find the template you need and change it using powerful tools.

How do I make changes in rp 5217?

The editing procedure is simple with pdfFiller. Open your rp 5217 instructions in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit rp 5217 printable form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share rp5217 form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!